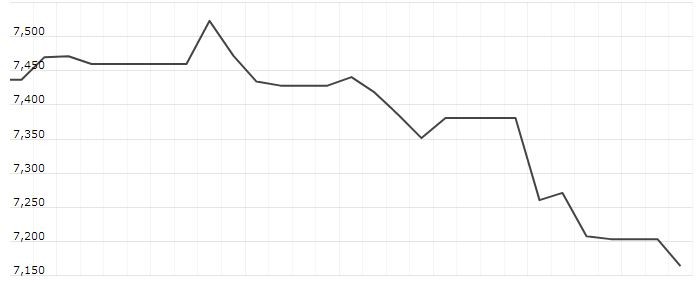

The FTSE 100 Futures is trading at 7,148.80 up with +0.26% percent or +18.80 point. The CAC 40 Futures is trading at 5,228.00 with a loss of -0.60% percent or -31.50 point. The DAX Futures is trading at 11,921.80 up with +0.56% percent or +66.20 point. The EURO Stoxx 50 Futures trading at 3,306.00 up with +0.61% percent or +20.00 point.

TODAY’S FACTORS AND EVENTS

According to Michael Zezas at Morgan Stanley, the latest US tariff increase, with the 25% levy on $200bn of goods having been postponed at the end of 2018 as trade talks got underway, would prove to be “temporary”, but “weaker markets may be required to encourage de-escalation.”

“Fears of another such move will be uppermost in most investors’ minds today. The current pullback will be a wonderful vindication of the ‘sell in May’ crowd, who will probably trumpet their prescience for the next six months, but investors can still point to the 20% gain from the December lows,” chipped in Chris Beauchamp at IG.

“This pullback was inevitable, sooner or later, and the China news provides a convenient headline. Further weakness into June and July would be more concerning, and the market still looks like it is prone to further declines on trade-related headlines.”

PREVIOUS DAY ACTIVITY

WORLD MARKETS

For the day the Dow is trading at 25,324.99 with a loss of -2.38% percent or -617.38 point. The S&P 500 is trading at 2,811.87 with a loss of -2.41% percent or -69.53 point. The Nasdaq Composite is trading at 7,647.02 with a loss of -3.41% percent or -269.92 point.

In other parts of world, Japan’s Nikkei 225 is trading at 21,067.23 with a loss of -0.59% percent or -124.05 point. Hong Kong’s Hang Seng is trading at 28,056.79 with a loss of -1.73% percent or -493.45 point. China’s Shanghai Composite is trading at 2,884.19 with a loss of -0.67% percent or -19.52 point. India’s BSE Sensex is trading at 37,027.19 with a loss of -0.17% percent or -63.63 point at 12:15 PM.