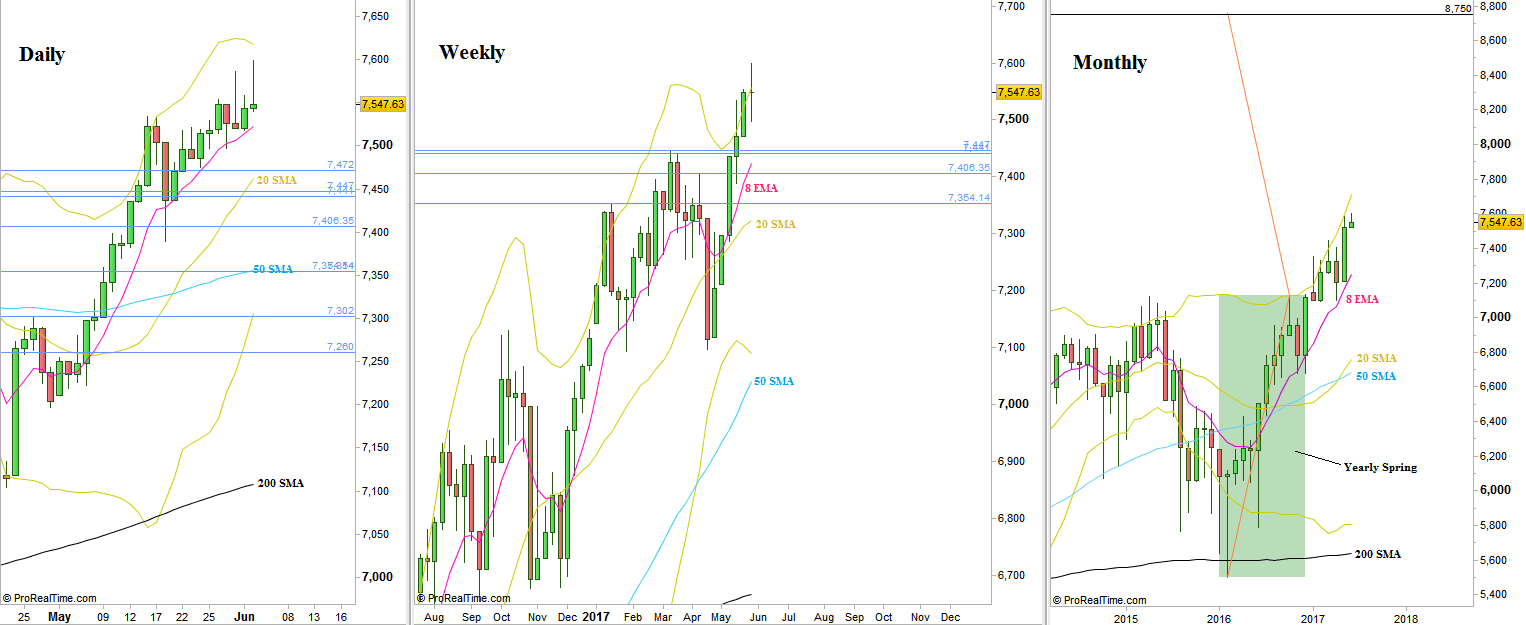

The FTSE has extended the May Monthly range upwards to touch the upper Bollinger band (very important for the midterm), and even made a new Monthly High on June, but as a whole, the passing Weekly bar shows a shortening of the thrust, finally closing on the middle.

Lately the market has achieved three major targets. The last two has been achieved over the passing week. The February Monthly Spring and the Monthly Swing Follow Through model which happens to be also a Pinbar on sloping 8 EMA for the last Quarter of 2016 – both at the band of 7580 and 7600. The next major target is quite far, the Yearly Spring pointing at 8750.

The coming week is probably going to be turbulent (the UK elections), and any swing on a timeframe below the Weekly should be watched carefully. As of price action, at the moment, it is not in a good spot to initiate a Daily (and above) Swing position. Taking out last Friday’s Low has good chances to press the price down to the Daily 20 SMA at 7475, which means a Weekly LL. But the attention should be focused on new Daily signs of strength back to test the High and perhaps making a new all time High, from which perhaps a new Weekly Swing can emerge the week after .

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.