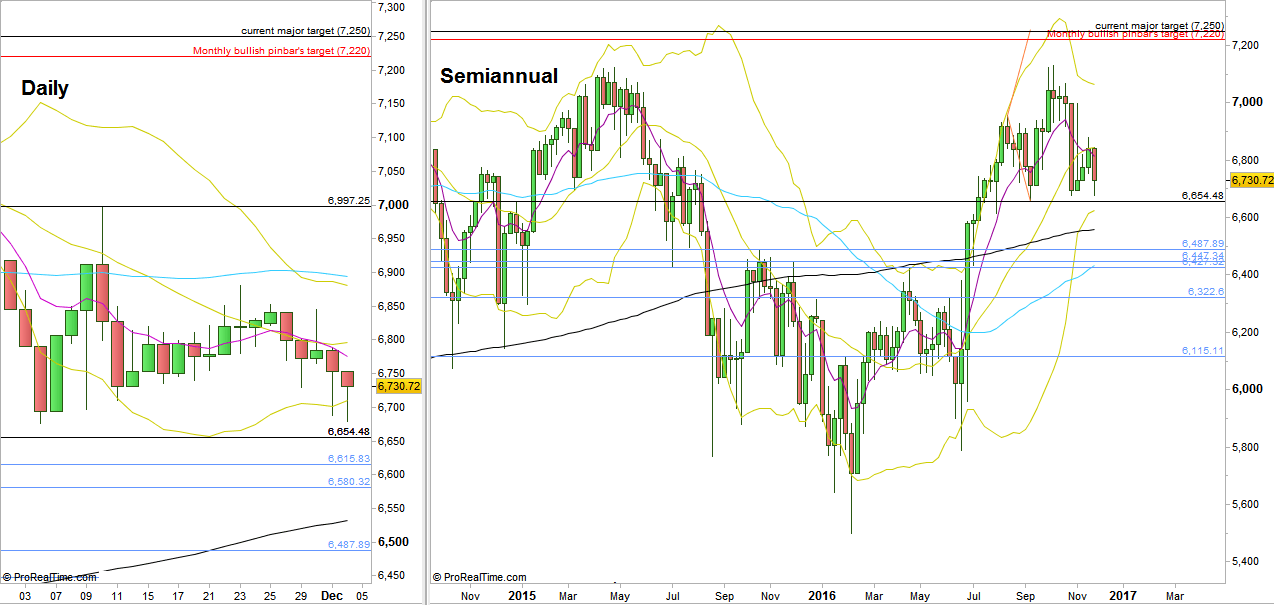

The passing week has turn the bullish tendency into bearish, causing the price to decline and penetrate the Daily lower Bollinger band, and to take out the Weekly Low at 6693.26. At last Wednesday, the last day of the Month of November, there was a bullish attempt to close the month higher, that turned out eventually into a false thrust up. There was a very good bearish signal on the daily by taking out last Wednesday’s Low. Pay attention that the target of the 1:1 magnitude has been fully achieved.

Eventually, the Monthly bar of November closed bearish but above the Monthly 8 EMA, a clear sign of strength.

The market is currently above the support zone of 6664-6700, where the Monthly 8 EMA lies. A thrust up above the last Daily pinbar’s High at 6752.93 only if right on Monday – is a bullish signal to reach the same magnitude of the pinbar at 6830, hence testing the Weekly High.

Any thrust down below the Weekly Low that doesn’t take out the Low at 6654.48 and ends up with a sign of strength is a good bullish opportunity for the midterm..

The current target of the post Brexit bullish pinbar (June 2016), at 7220 – is still valid. It can be identical to the current bullish target of the Weekly follow through after taking out a major LHBL, at 7250. Notice that the latter setup is based on respecting the Low at 6654.48 (the stop level), below the level of 6654.48 it is a clear bearish sentiment for the midterm.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.