The FTSE was one of the weakest stock markets throughout the passing week.

The volatility of the US elections shared by all other stock indexes was expressed as an almost inner bar for the previous Weekly bar, that was volatile by itself.

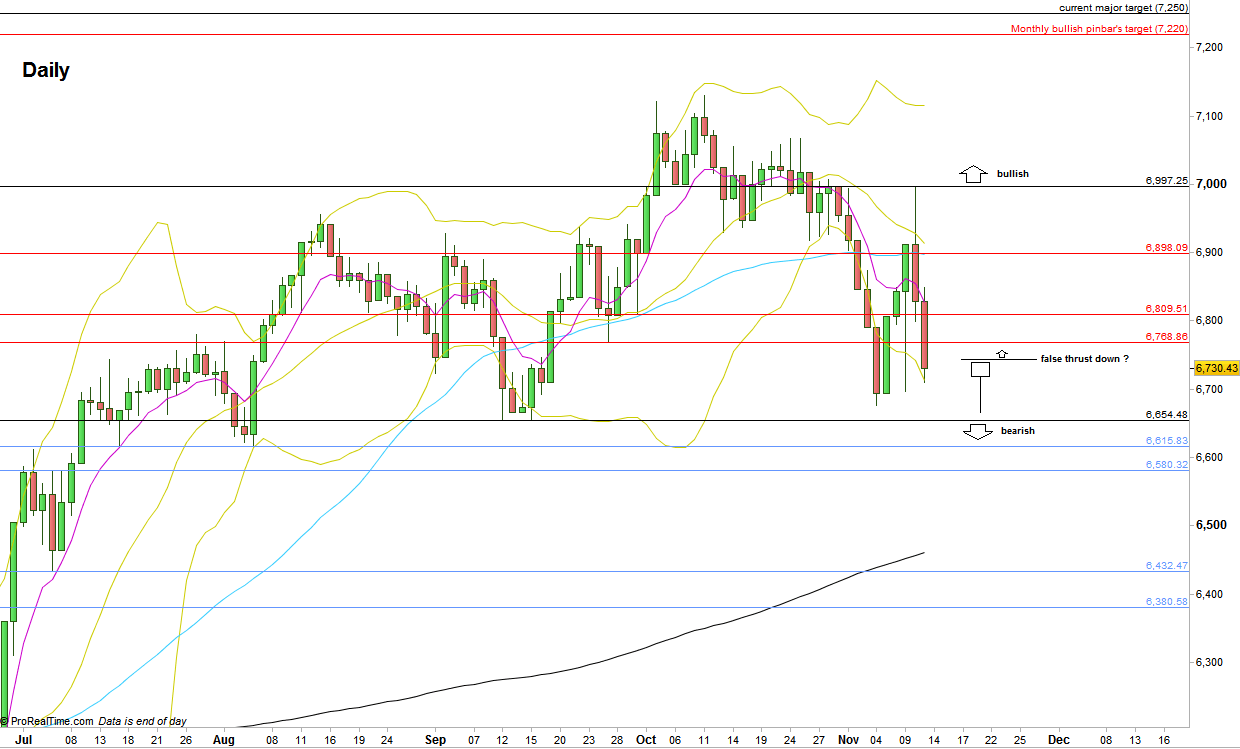

However, it wasn’t a Weekly inside bar as it took out last week’s High, a potential reversal up above the last major Low at 6654.48 (“potential” because of the luck of a thrust up eventually). Therefore, by price action, taking out the Weekly High in the coming week is a clear bullish sign.

Another bullish sign might come from a false thrust down that doesn’t take out the Low at 6654.48, followed by signs of strength. From the time perspective it would be more reliable if that thrust down takes place not before coming Tuesday, and the following sign of strength might be only by taking out the Weekly High created eventually – only by next week.

Taking out the Weekly swing Low at 6654.48 is a bearish signal to reach the mid range of the Brexit bar, approximately at 6200. The same bearish momentum should reach first the 6580 area prior to any major pullback. On the way down, there is a very strong support on a relatively big range – all the way down from 6580 to 6320, and I doubt not to see a major corrective rally before, one that eventually can turn the picture from bearish to bullish one on the longer term.

I wouldn’t be surprised to see for the coming week more consolidation at the current Weekly range, with a potential false thrust down as described before.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.