The passing week continued the Daily timeframe correction started the week before, in an A-B-C manner, forming a bearish setup to reach the 6738 level.

The bullish setup advised here on the previous review didn’t form completely as though the price did take out the High of the previous Friday, instead of a reaction and a follow through to go higher, the price made a new Daily Low, hence each bounce later (as occurred) is a totally different price action scenario (eventually forming a bearish setup to reach the 6738 level).

The strengthening of the GBP mentioned in the last review added to the pressure on the FTSE common to most other stock markets last week.

Had this index’s futures been traded during all Yellen’s speech impact and reactions, we would probably accomplish this target of 6738 with a huge range Daily bar, as has happened with the American indexes last Friday.

However, without a big shock, having a weekend behind, especially after rejecting the breakdown of last Thursday by a bounce up the day after (last Friday), the above bearish setup was finally negated.

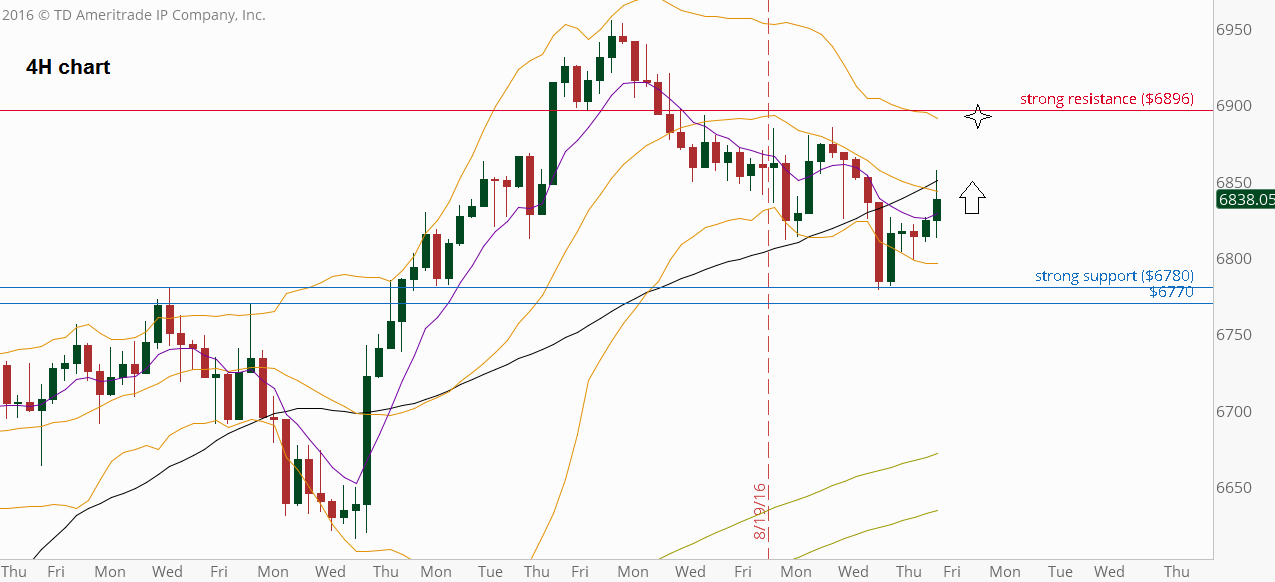

So, currently there is a bullish setup (created from the rejection of last Thursday’s false break down) to reach last week’s High, at 6885.4, probably testing also the resistance at 6896 within the same momentum. A Daily timeframe consolidation over that area later and a follow through up would be a good signal to get higher, probably to the target of the Weekly pinbar at the 6970-6980 level area.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.